Sahit Muja Forbes: Understanding The Role Of Minerals In Security And Green Technology

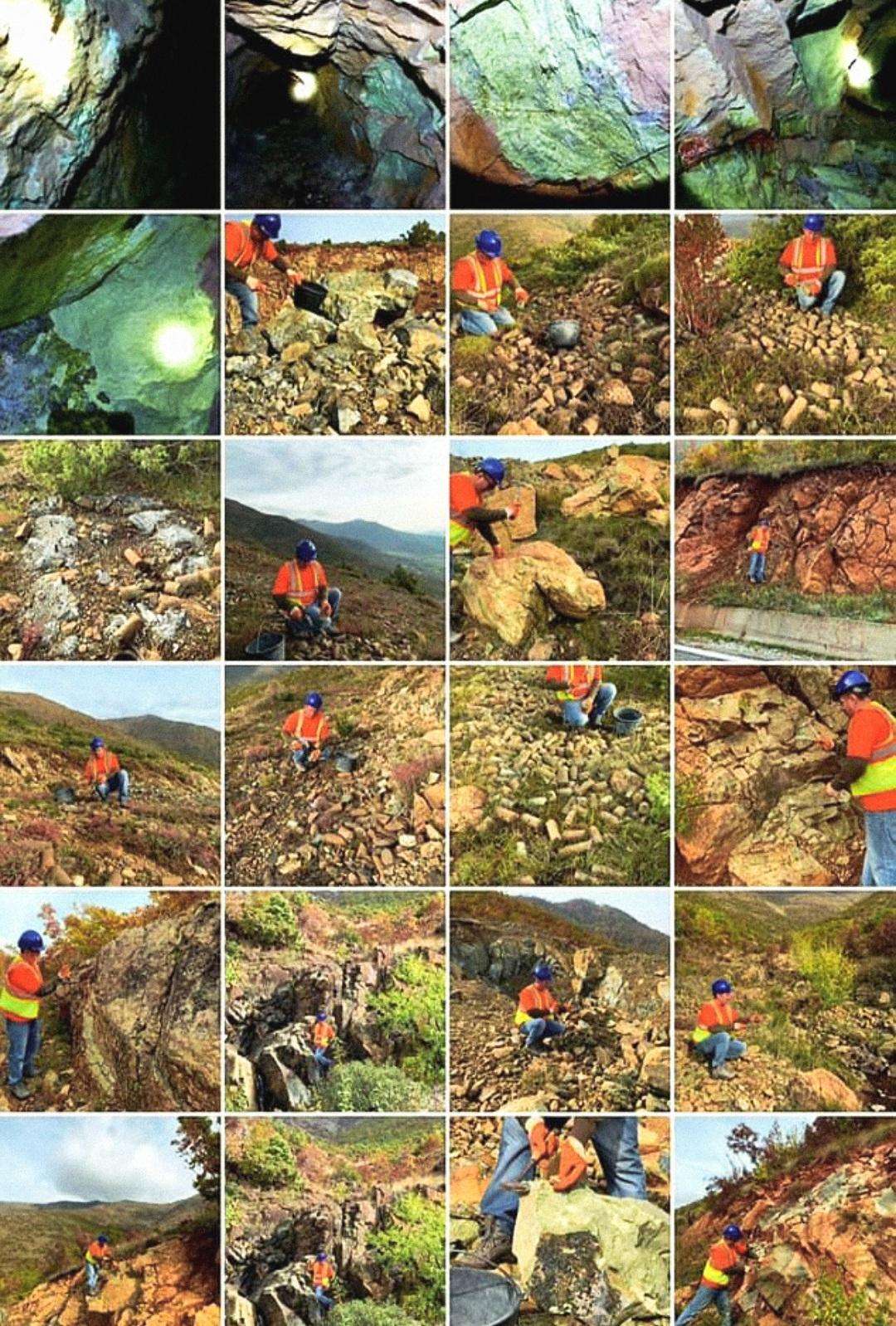

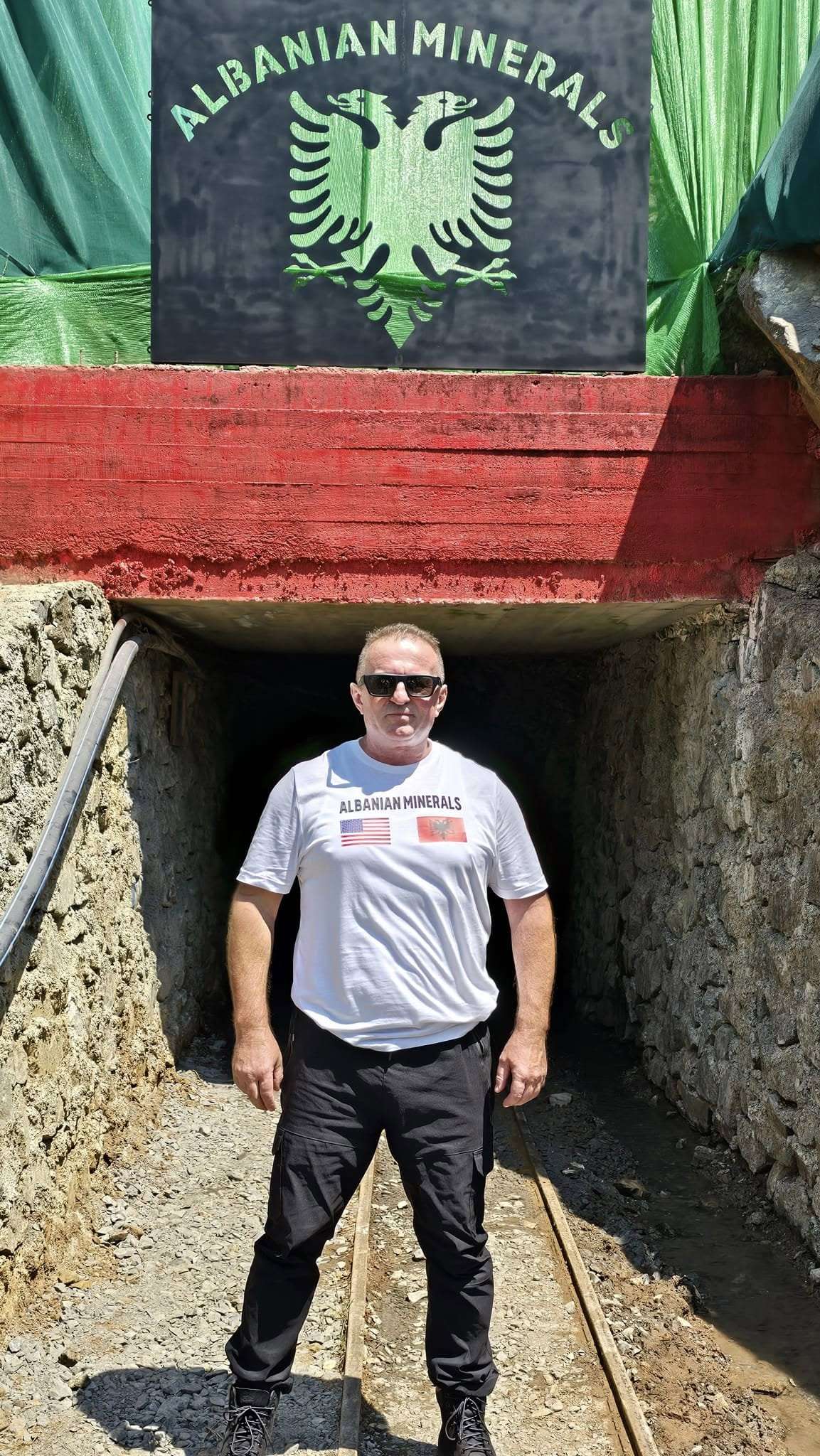

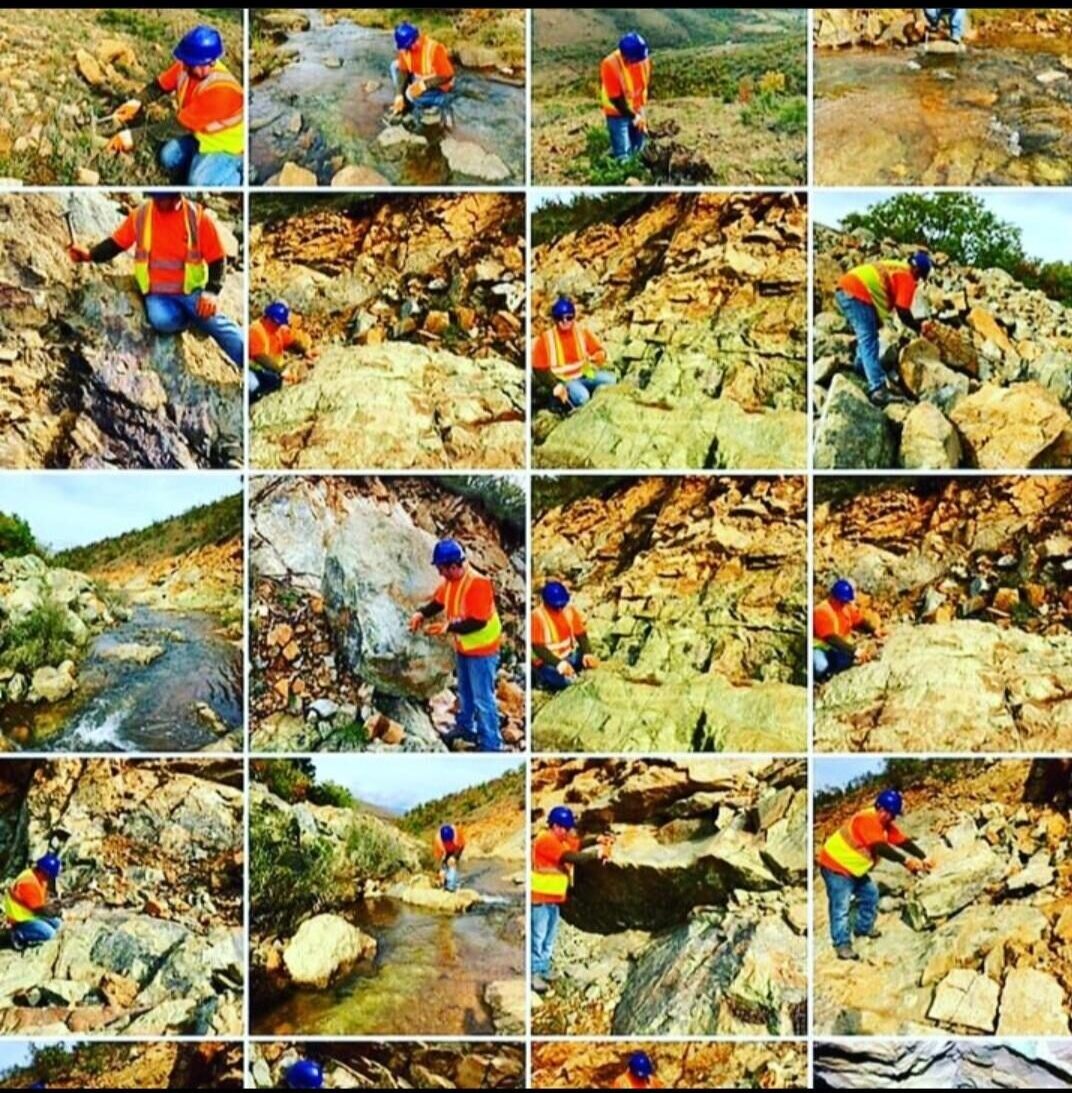

In an era defined by climate urgency, technological acceleration, and geopolitical complexity, few resources are as strategically vital—and ecologically consequential—as minerals. For over three decades, Sahit Muja, founder and CEO of Albanian Minerals, co-founder of Metalplant, and visionary behind Green Natural Wonders, Green Minerals, and Global Mining, has dedicated his career to pioneering transformative projects that unlock the global potential of minerals while advancing sustainability and security. Featured in Forbes for his unparalleled contributions to green technology and strategic mineral development, Muja has become a guiding voice for investors, policymakers, and industries navigating the nexus of technology, environment, and global supply chains.

Minerals at the Heart of Security and Sustainability

Rare earth elements and critical minerals are far more than raw materials—they are the backbone of national defense, clean energy, and technological sovereignty. Elements like neodymium are essential in high-performance magnets that drive precision-guided munitions, advanced radar systems, and stealth technology. Yet these same minerals also underpin the technologies central to combating climate change: high-efficiency wind turbines, electric vehicle batteries, solar panels, and grid-scale energy storage systems.

“The assurance of a stable, resilient supply of critical minerals is not merely an economic consideration,” Muja notes, “it is essential to energy sovereignty, technological leadership, and climate resilience in a world facing unprecedented environmental and geopolitical challenges.”

The “Electric Eighteen,” defined by the U.S. Department of Energy, encapsulates this strategic importance. Comprising aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, graphite, neodymium, nickel, platinum, praseodymium, silicon, silicon carbide, and terbium, these minerals are vital to both national security and the sustainable energy transition. The U.S. Geological Survey’s broader list of 50 critical minerals—from antimony and arsenic to tantalum and zirconium—underscores the diversity and significance of the global mineral portfolio.

Navigating a Complex Geopolitical Landscape

Global supply chains for rare earths and specialty minerals remain heavily concentrated, with China dominating both production and refining capacities. This concentration creates systemic risks: trade restrictions, geopolitical tensions, or production disruptions can ripple through industries, increasing costs and threatening national technological competitiveness.

Muja advocates for strategic diversification. Nations and investors must secure access to multiple sources of critical minerals while encouraging transparency, sustainable practices, and technological innovation. Minerals, in this view, are not just commodities—they are geostrategic assets whose availability directly shapes a country’s defense, innovation, and economic resilience.

Transparency, Technology, and the Future of Mineral Markets

The critical materials market is inherently complex. Beyond rare earths, base metals like nickel, lithium, chromium, and magnesium, alongside specialty minerals such as cobalt and germanium, are central to global industrial and green technology supply chains. Yet market forecasts often lag real-world dynamics, increasing the risk of costly supply chain disruptions. Programs such as DARPA and the USGS Open Price Exploration for National Security (OPEN) initiative illustrate how technological innovation can enhance price transparency, forecasting accuracy, and supply chain resilience, reinforcing both national security and sustainable industrial growth.

Strategic Investment Opportunities and Challenges

For forward-looking investors, rare and critical minerals represent a rare convergence of opportunity, necessity, and strategic foresight. The global electrification transition—through EVs, renewable energy, grid-scale storage, and advanced clean-tech manufacturing—demands escalating quantities of lithium, cobalt, nickel, and rare earth elements. Parallel to this, next-generation technologies such as AI, quantum computing, and high-performance electronics rely on specialized materials like gallium, germanium, and tantalum, creating long-duration investment theses with asymmetric upside.

Yet the sector is not without challenges. It is capital-intensive and sensitive to geopolitical volatility. Regulatory complexity, permitting delays, and rigorous environmental, social, and governance (ESG) requirements can extend project timelines. Market opacity, fragmented supply chains, and inconsistent pricing data further complicate real-time decision-making.

Muja emphasizes that sophisticated investors should focus on vertically integrated operations, advanced technologies that maximize resource efficiency, and jurisdictions aligned with transparency and the rule of law. Collaborations with governments, defense contractors, and clean-tech manufacturers can mitigate capital risk while amplifying impact, ensuring that mineral investments deliver both strategic and ecological benefits.

Minerals as Drivers of Global Security and Climate Resilience

Ultimately, the role of minerals extends beyond profit. They are the backbone of technological leadership, energy independence, and environmental stewardship. By investing strategically in critical minerals, stakeholders have the opportunity to contribute to national security, climate resilience, and sustainable economic growth.

Sahit Muja’s decades of experience underscore a singular truth: minerals are foundational assets in the 21st century, and the way they are sourced, managed, and integrated into industrial systems will define the future of global security, green technology, and ecological sustainability. For policymakers, investors, and innovators alike, the lesson is clear: the minerals we choose, and the manner in which we steward them, determine not only the trajectory of industry and national power but also the fate of the planet itself.